The Financial Technology (FinTech) industry has seen rapid, exponential growth in recent years with the shift away from traditional finance settings like physical banks.

The COVID-19 pandemic supported this growth, encouraging more people to buy online, and forcing businesses to embrace new digital models. Those same customers also discovered they could demand more from their banks in terms of customer service and technological advances.

With experts expecting this growth to continue to about $310 billion in 2022, there are no signs of the industry slowing down anytime soon.

That’s why now is the perfect time to study FinTech, particularly if you’re a programmer or developer. The salary you could achieve as a FinTech software engineer, data analyst or cybersecurity specialist is well worth the investment in your education.

The stats are on your side

This year’s EY FinTech Australia Census 2021 reported that Australia’s FinTech sector matured rapidly throughout the COVID-19 pandemic. Investors set records for capital raised, and increasing numbers of startups moved to post-profit.

In fact, with thousands of job opportunities appearing in the industry, FinTech is “poised to support our nation’s economic recovery,” according to Rebecca Schot-Guppy, CEO of FinTech Australia.

Meanwhile, the Census reports that 66% of Australian FinTech companies are now finding it more challenging to attract talent with the right mix of skills.

Recent changes in regulations such as the Customer Data Right (CDR) rules are leading to important shifts within the industry as well.

For example, open banking – where banks and financial institutions open up their data for regulated providers to access and use – is one emerging area that’s expected to grow. And while only 7% of Australia’s FinTech companies currently hold Accredited Data Recipient (ADR) certifications, a further 25% intend to follow.

Against this background, the Australian FinTech industry is proving to be a key player on the global stage, with a powerful trajectory.

This results in some impressive career options with impressive FinTech salaries to go with them.

Stability for your future

FinTech is the combination of two large industries in their own right – Finance and Technology. Combining the two industries opens a wealth of career opportunities.

Government inquiries into FinTech have shown that embracing technology will help Australia to become globally competitive. This will happen when not just the smaller startups, but also the larger corporations take advantage of FinTech’s benefits.

Both finance and technology are industries that traditionally offer high-paying roles. And both have a real need for specialist employees across a wide range of different areas.

As noted above, Australia is currently experiencing a considerable skills shortage. The EY Census found that 45% of FinTech company leaders listed ‘attracting qualified or suitable talent’ within their top three major challenges.

So studying FinTech and developing the ability to meet these shortages could well contribute to a long-term, stable career.

Salary ranges are busting open

Specific salaries in FinTech vary depending on your role, and we’ll talk more about individual roles later in the article. As a general indication, however:

- those in FinTech job roles that require a more technical skillset could attract a salary range of $80,000 to $180,000 per year.

- those in roles with a focus on non-technical skills can expect a salary range of $90,000 to $120,000 per year.

And in such an emerging industry, the sky is almost the limit when it comes to the salary you could earn as a financial technology consultant.

That’s because, right now, the demand for individuals who can combine finance and technology skills far outweighs the supply. As the industry continues to grow and new technologies develop, there will be more opportunities on offer and the financial technology salary base will continue to grow.

It’s safe to say that expertise in the right mix of technology and finance will be in demand for a long time yet.

Upskilling to secure your career

Maximising your opportunities in the industry isn’t just about knowing how to get a job in FinTech. It's also about making sure you have the right skills and knowledge to make the most of that job.

Those ‘right skills’, which are now becoming cores of any good FinTech program curriculum, now include both:

- technical skills such as coding and design

- non-technical skills such as creative thinking and communication.

Another way to maximise your career potential is to widen the base of employers you consider. Gone are the days where working for a startup was considered ‘the risky move’. Technology advances are making startups more common, and more viable as a strategic career move.

In fact, if you can think one step ahead in the fast-moving FinTech industry, startups may end up providing the best opportunities. You could even set your own bar for a FinTech project manager’s salary.

This is why studying FinTech and obtaining a globally-recognised qualification through a university like UNSW can guarantee job security.

Stimulating and rewarding work

The rapid growth we mentioned earlier can also make a career in FinTech incredibly exciting. Being on the cutting edge of innovation means the industry offers a fast-paced, challenging environment.

Any role within FinTech requires the ability to forward think and anticipate what’s needed in the market.

"It’s hard to keep up with the speed of innovation in this space," explains UNSW Senior Lecturer, Dr Thomas Ruf. "Everything’s up for grabs and it has the potential to affect other parts of our lives."

So if you thrive on adventure and love finding smart technological solutions to people’s problems, a career in FinTech could be just what you’re looking for.

Beyond this, the ability to ask questions and devise solutions could see you developing, or at least assisting with, ‘the next big thing’ in financial technology apps. There’s potential for you to help transform entire systems and revolutionise entire industries.

It’s exciting to realise that you could end up having an instrumental impact on the world as we know it.

So if you’ve been searching for greater job satisfaction, FinTech offers it in droves.

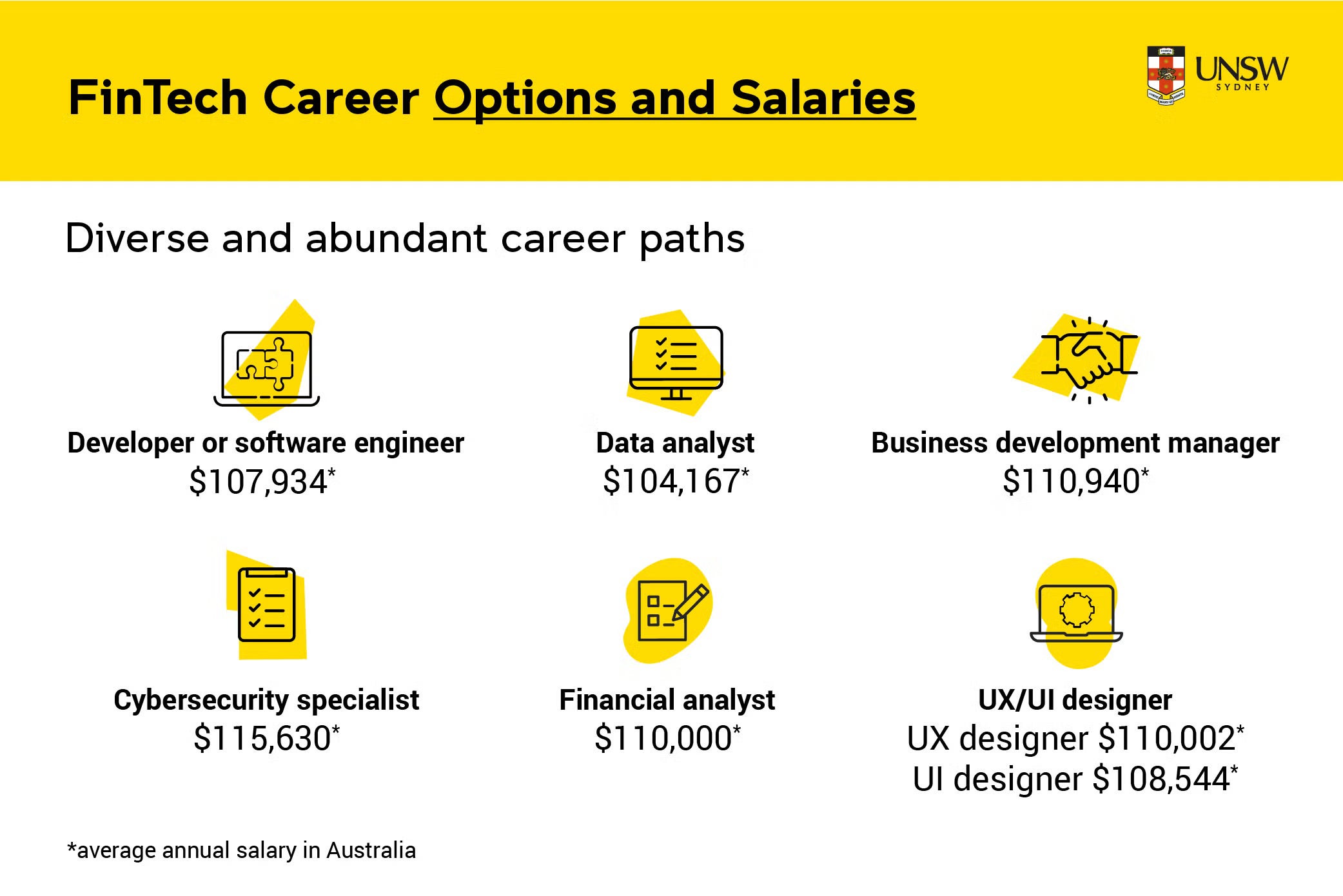

Diverse and abundant career paths

There are many different career possibilities within the world of FinTech, and salary expectations for most of them in Australia are strong.

“In what used to be a boring space where big banks dominated, we now see thousands of new entrants,” says Dr Ruf. The game, as they say, is on.

Whether you decide to work for a big bank or a new startup, here are just some of the roles available to you.

Developer or software engineer

Otherwise known as ‘programmers’, developers and software engineers have one of the most critical roles when it comes to bringing new technology to life. They’re the ones actually making it happen.

Developers often specialise in:

- blockchain

- AI

- big data.

They typically need to know a range of programming languages, including:

- Java

- Python

- C++

- HTML

- PHP.

Developers also need the ability to code for both websites and mobile devices and to easily switch between the two.

The average salary for a developer in Australia is $107,934 per year. Entry-level positions start at $93,730 per year, while the most experienced workers make up to $140,633 per year.

Yet the salary you earn as a FinTech software engineer could be even higher.

Data analyst

Data Analysts take raw information, analyse it and then turn it into valuable insights. These insights provide actionable intelligence for a company to use to their own benefit or to provide a better customer experience.

The average data analyst salary in Australia is $104,167 per year. Entry-level positions start at $90,970 per year, while most experienced workers make up to $129,506 per year.

Financial analyst

As the title suggests, a financial analyst compiles and analyses financial information to help a company become more profitable. Generally, you’ll need a qualification in accounting or finance to perform this role.

The average financial analyst salary in Australia is $110,000 per year. Entry-level positions start at $90,000 per year, while most experienced workers make up to $135,075 per year.

Cybersecurity specialist

FinTech companies handle a lot of sensitive, personal financial data that they need to keep safe. A cybersecurity specialist ensure that software applications and systems are secure to prevent data from ending up in the hands of malicious hackers.

The average cybersecurity salary in Australia is $115,630 per year. Entry-level positions start at $97,964 per year, while most experienced workers make up to $156,000 per year.

UX/IU designer

User Experience (UX) and User Interface (UI) designers determine how a software application will look and function from a customer’s perspective. For example, apps must be easy to use and navigate to maximise user adoption.

The average UX designer salary in Australia is $110,002 per year. Entry-level positions start at $95,000 per year, while most experienced workers make up to $139,849 per year.

The average UI designer salary in Australia is $108,544 per year. Entry-level positions start at $90,416 per year, while most experienced workers make up to $137,479 per year.

Business development manager

A business development manager oversees the growth of an entire FinTech business at every stage, from development to launch and beyond.

Their role is to ensure both product success and overall financial profitability.

The average business development manager salary in Australia is $110,940 per year. Entry-level positions start at $90,000 per year, while most experienced workers make up to $150,000 per year.

The opportunities are vast

These are only a selection of roles available within FinTech. The industry is both varied and vast, making it highly likely that you’ll find a role that truly speaks to your interests and strengths.

Keep in mind too that the salaries above are averages, and are often taken from a relatively small pool of roles. As with the salary mentioned for a FinTech software engineer, the numbers don’t necessarily reflect what’s possible in leading FinTech companies or FinTech specialist roles.

There’s a good chance you could earn more than the average, depending on the specialisation you choose.

There are opportunities aplenty in the tech-focused roles, but also many other roles in areas like sales and marketing. The only limiting factor is you.

Learn more about the range of FinTech career options on offer.

Futureproof your career

The world of FinTech offers a wealth of attractive options for a professional who wants to future-proof their career. It also provides them with ample room to move as their skills and interests develop over time.

Wondering how to get started with a career in FinTech? The first step is to complete a qualification like the online Master of Financial Technology at UNSW. This will provide you with the in-demand skills that the best FinTech employers are looking for.

If you’re not quite sure whether a master’s degree in FinTech is for you, read more about what to expect from the course.

Learn more about how you can future-proof your career in FinTech and become a FinTech expert with UNSW’s Master of Financial Technology online program.