Careers in FinTech: Industries, skills and requirements

On 1 July 2020, Australian banks launched their open banking system, which allows bank customers to give accredited third parties access to their bank records. It was a move designed to give bank customers more power. It also caused a positive ripple effect throughout the field of financial technology, or FinTech. Open banking has created a wealth of opportunities for businesses looking to provide consumers with a wider array of economically efficient options.

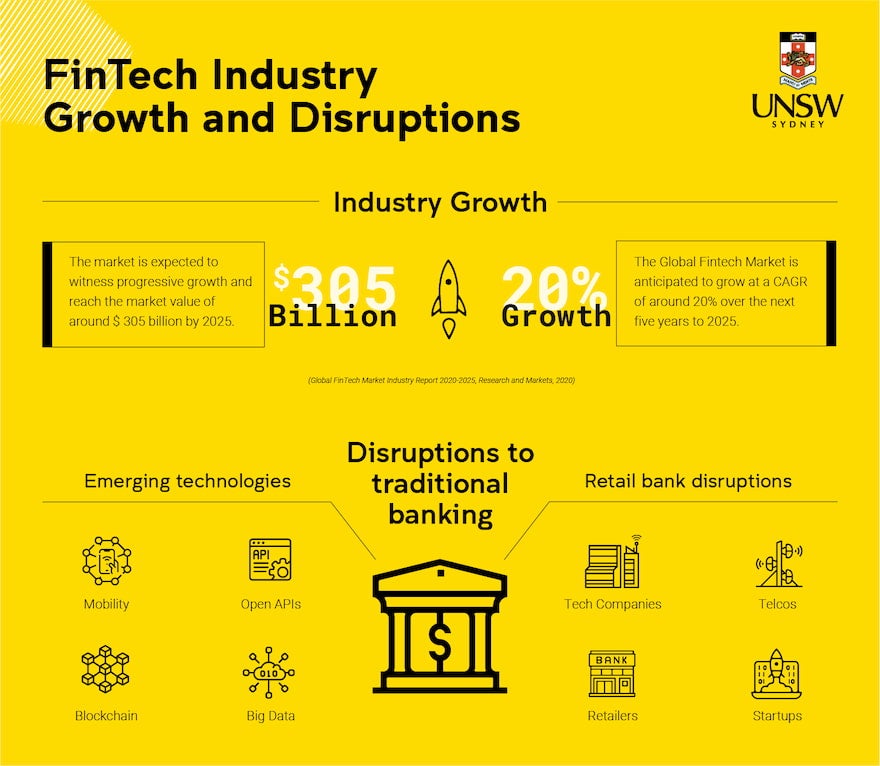

But FinTech isn’t just about cheaper banking services for consumers. Financial technology is being used by disruptive start-ups and legacy financial institutions alike to find efficiencies and create wealth.

FinTech is also generating job opportunities for upskilling finance professionals, career-changing IT professionals and early career employees who are ready for finance’s fourth industrial revolution.

It’s a good time to be thinking about preparing to pursue one of many careers in FinTech.

FinTech and the financial services industry

The COVID-19 pandemic played a key role in FinTech’s growth in Australia. Lockdowns changed how customers and companies engaged in business, and those changes are expected to have a lasting impact. In its report Pulse of Fintech, KPMG agrees that the response to COVID-19 will be one of the key drivers of investment in FinTech for the foreseeable future. The report also emphasises the importance of data analytics in the financial services industry. Financial institutions are increasingly looking to data to provide greater insights into customers and risks.

While lean, nimble start-up companies have led FinTech’s disruption of the pinstriped financial establishment, large legacy banks are increasingly embracing FinTech’s benefits. Some issues, such as regulation, remain unsettled. However, the enthusiasm surrounding FinTech suggests that there are no signs of it slowing down. It also means FinTech is rife with opportunities for professionals seeking a unique, progressive career.

Technical skills for a career in FinTech

Individuals interested in careers in FinTech must have solid technical skills in both traditional and emerging tech competencies.

Blockchain

As blockchain becomes a more viable form of economic transaction, FinTech professionals should have a firm grasp of its language and architecture. In particular, understanding the data structure of blockchain can help FinTech professionals develop more efficient blockchain systems.

Programming

Knowledge of a range of programming languages, such as Python, Java, C++ and SQL, is crucial for FinTech professionals. A background in these languages can allow professionals to develop key FinTech elements like user-responsive websites and mobile apps.

Compliance

Because FinTech’s regulatory parameters are still being settled, FinTech professionals must be able to adapt to evolving rules to operate ethically and minimise risk. Their work may even help shape the foundation of a long-term compliance strategy.

AI and machine learning

Artificial intelligence can be applied to websites and mobile apps to enhance customer service, improve security and detect fraud. Solid AI and machine learning skills can help FinTech professionals build smart systems that meet consumers’ needs.

Data science

FinTech professionals with strong data science skills can create risk models, analyse customer behaviour and forecast future trends.

App development

FinTech thrives on intuitive applications that allow customers to interact with them with ease. FinTech professionals should have the capacity to build apps that are simple to use yet sophisticated enough to handle complex commands.

Soft skills for a career in FinTech

Soft skills are often an afterthought in careers like FinTech, but they are the conduit between high-level technical prowess and the rest of the world. They help people understand why FinTech matters, and why it deserves attention as finance and technology continue to evolve.

Tech savviness

As technology is a fundamental element of FinTech, professionals need to have a firm grasp on the basic building blocks that drive technology. This provides individuals with a rudder that can help them navigate FinTech’s twists and turns as they occur.

Communication

The ability to communicate effectively with colleagues, superiors and other stakeholders is a valuable, transferable skill in every job. It’s not just about speaking or writing well, what matters is being able to tell and sell a story that connects with the audience.

Problem-solving

Problem-solving or creative thinking is another soft skill that is in high demand in FinTech. The ability to approach problems from a different angle is in the DNA of FinTech, whether an individual is launching a well-funded start-up or tackling their daily workload.

Adaptability

FinTech is relatively new to the financial scene and constantly evolving. FinTech professionals must be able to adapt to emerging technologies and monitor the latest trends.

Leadership

FinTech professionals must be adept at setting goals and encouraging, motivating and guiding others to meet those goals.

Collaboration

A collaborative approach can improve project efficiency and encourage synergy among stakeholders.

Creativity

Creative thinkers can help improve existing FinTech applications and conceive new and innovative ideas.

Careers in FinTech

Around the world, there is high demand for FinTech professionals, particularly those who can push the boundaries of this exciting technical frontier. One of the key indicators of that need is the increasing popularity of banking apps on mobile phones.

Of course, FinTech is about much more than mobile banking apps. Here’s a guide to some of the possible careers in FinTech.

FinTech business analyst

The role of the business analyst is difficult to pin down – it means different things to different organisations. The International Institute of Business Analysis describes it as follows:

A business analyst works as a liaison among stakeholders to elicit, analyse, communicate and validate requirements for changes to business processes, policies and information systems. The business analyst understands business problems and opportunities in the context of the requirements and recommends solutions that enable the organisation to achieve its goals.

Now you can see why a career in FinTech requires so many different technical and soft skills!

As a FinTech business analyst, you could be working as a product manager in a scrum team, delivering enhancements to mobile banking apps. You could be developing analysis and business cases for vendor selection and partnership agreements in new business opportunities.

In this role, you’ll be working in a collaborative team, communicating with stakeholders and driving technology towards achieving commercial goals.

Business analysts can expect to earn an average salary of $90,000.

FinTech strategy analyst

Lindsay Davis is an American strategy analyst who’s recently been promoted to Director of Intelligence. She has built her career on advising management executives on the competitive landscape, go-to-market strategies and product roadmap prioritisation.

Davis describes her business’s driving force as, “turning data into actionable strategies as a vital resource that the industry needs to build the next generation of FinTech." Her career as a strategy analyst evolved from graduate studies in economics and international business.

Strategy analysts can expect to earn an average salary of $81,229.

Portfolio analyst

While the strategy analyst applies industry analysis to business performance, the portfolio analyst brings a sharper focus and applies it to portfolio performance. This role varies from company to company, but that portfolio is likely to belong to an institutional investor, a fund manager or an asset allocation.

Portfolio analysts tend to have a stronger financial background so they can understand how financial metrics and regulatory or legal restrictions can impact a portfolio. They also need above-average communication skills as they may be explaining portfolio performance to clients, as well as their superiors.

Portfolio analysts can expect to earn an average salary of $98,750.

Investment banking analyst

Investment banks like Macquarie Group and UBS help large companies or organisations to manage their money and financial transactions. They may facilitate initial public offerings (IPO), issues of new securities to raise capital, or mergers and acquisitions. Investment banking is a demanding job with a lot of responsibility, but it also comes with some handsome compensation.

Investment banking analysts use massive amounts of data to build a better picture of financial consumer demographics. They also conduct deep research into specific industries – so you might be focusing on healthcare, manufacturing or emerging markets.

Despite the heavy focus on data and analysis, investment banking analysts spend a lot of time communicating. On one day you may be writing reports for an IPO prospectus document. The next day you may be speaking in front of a room full of retail or institutional investors.

Investment banking analysts can expect to earn an average salary of $116,000.

Blockchain developer

LinkedIn kicked off 2020 with the news that blockchain is the most in-demand skill in Australia - as well as the United States and most of Europe. That’s no surprise to the Australian Government, whose own report revealed that there are 14 job openings for every blockchain developer in Australia.

Blockchain developers have high level technical skills, starting with front and back-end web development. On top of that, they must have a deep understanding of data structures, cryptography and smart contracts. It’s these self-executing smart contracts that make blockchain’s distributed ledger so powerful – they are contractual agreements between different parties literally written into the code.

Blockchain developers can expect to earn an average salary of $180,000.

Preparing for a FinTech future

In its most basic form, FinTech is simply technology for the financial services industry. Where it gets interesting is when a lean, nimble start-up FinTech company disrupts the traditional financial establishment. Big old banks often have complex, legacy technology that can’t compete – so they end up working with FinTechs, acquiring FinTechs or creating their own FinTech in-house.

Dr. Goncalves-Pinto said the rapid acceleration of FinTech services has led to the creation of several roles that will need to continuously adapt within the evolving financial services landscape.

“The areas of most growth in finance and banking will be in applied AI, deep learning, biometrics, cyber security and regulation,” Goncalves-Pinto said.

You can prepare for a FinTech future today with UNSW Online’s Master of Financial Technology. The course has been designed to develop the technical skills and soft skills required to meet the technology needs of the financial service industry. And because it’s 100% online, you can apply your new FinTech skills immediately – so you’ll be ready for new and emerging FinTech jobs as they evolve.

Learn to respond to the technological revolution in finance with UNSW Online here.