How to start a FinTech company – tips for success

According to a PwC survey, 88% of large, well-established financial institutions (incumbents) feel that part of their business is at risk to standalone financial technology (FinTech) companies. Incumbents appeared to be immune to competition from startups for a long time; they had loyal long-term clients and the systems in place to manage constantly-evolving and onerous regulations.

So what exactly qualifies as a FinTech startup? And how have they managed to get the attention of the massive incumbents?

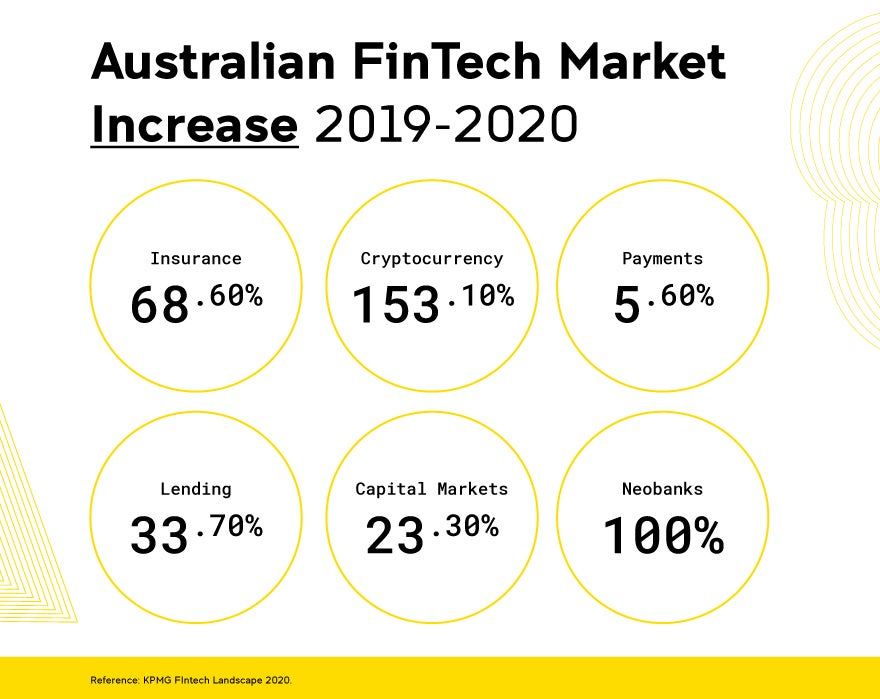

A FinTech startup uses new technology to improve the delivery of financial services. They are disrupting the financial services sector by addressing previously overlooked consumer pain points in industries like insurance, cryptocurrency, payments, lending, investing, and risk management

The FinTech landscape is incredibly diverse, but by being aware of the broad trends and learning from those who came before you, the path to success becomes a lot clearer.

How financial technology is disrupting industries

Financial technology is disrupting several industries in a variety of ways - but there are some common themes.

Insurance

In early 2017, Lemonade set a new world record; the insurer’s artificial intelligence (AI) powered technology processed and settled a theft claim in only three seconds - no paperwork required. The obvious takeaway is that artificial intelligence is reducing the need for human resources. But the feat also shines a light on the customer-centric approach that FinTechs are using to disrupt their industries. Instead of waiting for days - at least - for the claim to be settled, the situation was rectified for the customer in seconds.

Lemonade’s world record is just one example of how financial technology is making the previously unthinkable possible. And it’s not just happening in the insurance industry.

Cryptocurrency

Zac Prince’s cryptocurrency startup provides another example of what’s possible. Many people were frustrated at the inability to earn interest on their Bitcoin and other cryptocurrency in a safe and secure way. Prince heard the chatter and started BlockFi in 2017; the company allows users to earn up to 8.6% APY on their cryptocurrency.

BlockFi has thrived because it:

- Addresses a need that was perceived as too small for the big players to deal with.

- Designed a flexible solution that can satisfy a large number of crypto enthusiasts.

- Takes cybersecurity very seriously.

Above all, BlockFi became intimately familiar with its target market and created a solution with a top-notch user-experience.

Payments

Around half of millennials would rather pay for small items with their mobile phone than with cash. Mobile payments have achieved widespread adoption for a few reasons including:

- Speed: tap-and-pay is faster than a traditional credit card transaction. People are busier than ever - or at least it feels that way - so even a few extra seconds makes a massive difference in the minds of consumers.

- Greater convenience: Nobody wants to carry around a bulky wallet filled with credit cards and loyalty cards. By going mobile, consumers have a few less things to carry around.

- Better security: paying with a mobile wallet is actually safer than paying with a plastic credit card. Mobile payments have multilayered authentication, while merchants rarely confirm that you’re the legitimate holder of a plastic credit card.

The shift towards mobile is not only happening in the financial services world; people have been eschewing the physical in favor of mobile in other sectors. DocuSign, for example, has eliminated the need to sign physical contracts with its electronic agreement enabling software.

Lending

There are trends in financial services that originated in other sectors. The sharing economy started with taxis and hotels, but has now spread to the lending industry. Banks formerly acted as intermediaries for providers and users of capital - if someone couldn’t find acceptable terms, they were often out of luck. Peer-to-peer (P2P) lending platforms have sprouted up to allow individuals to get loans from other individuals, democratising the acquisition of capital.

Investing

Robinhood is a company that has succeeded by democratising - but in the stock trading industry. Before the FinTech app came onto the scene in 2013, young people often felt like they didn’t have enough money to invest in the market. Robinhood democratised investing by taking away account minimums and trading fees. Its actions put established brokers like E-Trade and Charles Schwab on their back feet.

Risk management

The countless FinTech innovations come with potential consequences, however, with increased risk being chief among them. According to Deloitte, we are seeing “new characteristics of risk that might not have existed in the recent past.” Startups need to assess and mitigate these risks, and there will always be a market for solutions that can identify and manage them.

Many of the top FinTechs share the four things in common:

- A customer-centric approach that results in an excellent user experience.

- Convenience and speed, without sacrificing security - and often enhancing security.

- Watching what’s going on in other industries - even outside of financial services - and applying it to their industry when applicable.

- Democratising what was previously doable for a select few.

FinTech startup tips for success

So you surveyed the landscape and came up with an idea for the next big FinTech startup, but now you’re wondering:

How do I bring it to life?

We sat down with SelfWealth CEO, Andrew Ward, to learn about his journey and advice for aspiring FinTech entrepreneurs. Here are his five top tips for FinTech success:

#1 Know your motivation and back yourself

Ward doesn’t sugarcoat what it takes to turn your startup into a thriving company with revenue and employees. He says, “No matter how hard you think it may be, from both a personal and professional experience, nothing that you read in books ever is going to prepare you for what you’re about to embark on.”

It could take years before you generate enough revenue to self-sustain your operations. You’ll have to convince venture capitalists that your startup will pan out because they are the ones that can help you keep the lights on until it does. Ward notes that at the same time, those around you “will think you’re ruining your life.” Their fear isn’t completely misplaced; nine out of ten startups fail, after all.

How do you make it through? According to Ward, you’ll have to “believe it’s going to work, even to the point where people think you’re crazy.” You’re going to be taking on incumbents that have massive advantages in resources and experience. But if you truly believe that your idea will revolutionise your industry, you can find the motivation to bring it to fruition.

#2 Test and learn

Ward cautions, “[Your product] is never perfect when you first launch it… No one’s ever done it.” With that in mind, you need to constantly test your product and learn from your findings.

Try to get feedback from strangers as opposed to family and friends. Strangers are more likely to tell you what they really think because they don’t care about your feelings. Ward says that you should actively seek out critical opinions. “Don’t tell me why you like it, just tell me why you don’t think it’ll work.”

Harsh feedback - assuming it is legitimate - is the best thing that can happen for your startup. The earlier the better. That’s because the longer you go down a coding path, the harder it becomes to reverse course. Moreover, you simply don’t want to wait years to find something out that you could have learned in months. At best, you’ll take longer to make it. At worst, you’ll blow up before you can get there.

#3 There’s always a boss in FinTech

According to a Guidant Financial and Lending Club survey, 37% of aspiring entrepreneurs cite the desire to “be their own boss” as a motivating factor to pursue their dreams. But that doesn’t jibe with reality, at least in the FinTech world. As Ward succinctly puts it, “There’s always a boss.”

If you’re the CEO, you’re reporting to the chairman and the board of directors. You have shareholders, who, for Ward, were responsible for a lot of stress. If you’re taking money from strangers, friends, and family, you want to do right by them and validate their belief in you. The last thing you want to do is squander their hard-earned money.

The buck stops with you as the founder and CEO. If people aren’t using your product, there’s no one else to point the finger at. On the other hand, if you’re a mid-level employee at a typical company, this isn’t the case; you don’t bear the full weight of product failures because you don’t have unilateral decision making power.

#4 Keep the dream alive

In the face of long odds, you must remember why you went down this road in the first place. Ward credits his passion and desire to get his idea out into the world. “The money’s nice… but the biggest thing for me was being recognised for being creative.”

That day when you have the money and recognition could take years, however, so you have to find ways to keep the dream alive in the interim. Investors will get impatient, wondering why it’s taking so long. At the same time, you’ll have to keep paying your staff and give them confidence that you’re moving in the right direction. Your staff, remember, is also sacrificing stability by working for your startup as opposed to an established company.

Amidst these doubts, Ward says, “You can’t have a down day.” You need to reassure your investors and staff that everything is going to be alright. Ward adds that, “You need to be that constant source of hope at the top.”

#5 Have a plan G

By now, it should be clear that building a startup is never a smooth process - a lot of things will go wrong. Ward says that you need to have “Plan G.” This way, if (when) Plan A, B, C, etc. don’t work, you know what to do next. He adds that, “You can’t be one of those people, that you all know, whether it’s friends and family, who just, you can’t change their opinion.”

The key is to be adaptable and pivot when necessary. You might make a massive pivot once every few years. You will make smaller pivots, however, at a much higher frequency. According to Ward, you’ll be “reshaping your opinion daily.” You will start to value your thinking time more than ever because “99% of it happens in the head.”

Position your FinTech company for success

Preparation is a make-or-break factor when it comes to starting a FinTech company. You can’t go into it blind and expect to find success.

You need to evaluate the landscape, come up with an idea that solves an unmet need, and then be prepared to stick with it through thick and thin. But that’s easier said than done.

UNSW's 100% online Master of Financial Technology can give you the tools you need to embark on this arduous, but potentially rewarding journey. The capstone units - “Managing a FinTech Startup” and “Applied FinTech Project” - give you an up-close look at the challenges that come with launching a FinTech startup.

Learn more about how you can gain the skills to respond to the technological revolution in finance and prepare to launch a successful FinTech company with UNSW Online here.