Current and future trends in Australian corporate finance

How an organisation chooses to finance itself is one of the most critical decisions it can make. Professionals who work in corporate finance, the area of finance that underpins how companies source their funding and structure their capital, have the power to help their companies succeed or lead them to financial ruin.

Understanding the fundamentals of corporate finance is important for anyone in business and the field is evolving rapidly.

New opportunities represent new risks, however, so business professionals need to understand all aspects of the corporate finance landscape.

What is corporate finance?

So, what is corporate finance exactly? Within the broader field of finance, corporate finance focuses on corporate funding, capital and investments. It is concerned with all of the financial aspects of running a business and it encompasses all the necessary tools and strategies that are used by finance managers and leaders to ensure their organisation remains financially healthy and successful.

The primary goal of corporate finance professionals is to maximise shareholder value. Shareholder value is essentially the value generated for a company’s investors and corporate finance strategies are based on enhancing this value over time, through sound financial decisions that increase the company’s stock price and strengthen its long-term viability.

Shareholder value is measured through various metrics, which include return on investment (ROI), earnings per share (EPS) and profitability.

Debt financing

The two key types of financing within corporate finance are debt financing and equity financing.

Debt financing is when a company raises money using debt instruments such as bonds or loans. The company sells these instruments to investors or financial institutions with the promise to pay back the money over a period of time, typically with interest.

This type of financing allows a company to scale up or grow its operations without diluting its ownership. It does, however, come with the downside of having to repay funds and interest at the same time.

Equity financing

Equity financing involves raising capital through the sale of shares.

Here, a company issues shares that represent a stake in or part ownership of the business. This type of financing enables companies to raise funds without incurring debt. It does, however, give investors ownership rights and with this comes the potential for dividends and capital appreciation. Equity financing dilutes shareholder equity, which impacts existing shareholders. As more shares are made available, each owner’s percentage of the overall business decreases.

Why is corporate finance important?

Corporate finance management plays a pivotal role in shaping an organisation’s strategic decisions and ensuring that the business becomes and remains financially healthy. Specific benefits of effective finance management include the following.

1. Aids better decision making

A primary function of corporate finance departments is to provide company leaders with a solid foundation for decision making. Through mechanisms such as financial data analysis, budgeting and forecasting, leaders can assess the profitability of different parts of the business.

Corporate finance data also aids better decision making by enabling business leaders to gain insights into the future. By evaluating financial metrics and performance indicators, leaders can assess not only their organisation’s financial health today but also the potential economic viability of its projects and investment opportunities in the future. These insights can help leaders make informed decisions about the company’s future direction that align with its overall goals, mission and vision.

2. Assists with research and development

Innovation is the driving force behind many organisations. Corporate finance strategies play a crucial role in this by supporting innovative research and development initiatives through the allocation of funds.

By strategically earmarking funding for innovation, companies can stay competitive and create new revenue streams that help them invest in their long-term growth. Effectively managed corporate finance structures ensure that research and development initiatives and innovations are aligned with the company’s strategic goals. This in turn helps foster a culture of innovation and adaptability.

3. Enables coordination between business units

Large organisations often have several business units, each with its own set of financial needs and objectives. Corporate finance strategies can serve as coordinating mechanisms, aligning the financial strategies of different units with the overall goals of the organisation.

Using corporate finance strategies as coordinating mechanisms also ensures that resources are allocated efficiently, synergies are leveraged and the organisation maximises cohesion and value creation across business units.

4. Promotes expansion and diversification

Businesses looking to grow and succeed need to expand and diversify. Corporate finance professionals provide the necessary financial analysis and planning to facilitate this.

Organisations can expand in any of a number of ways, such as through mergers, acquisitions or organic growth. Corporate finance professionals can assess the potential risks and returns of different initiatives and ensure that they contribute to the financial health of the company.

5. Improves risk management

Every business faces risks, including market fluctuations, economic downturns and other unexpected events, from natural disasters to supply chain disruptions. Corporate finance teams play a crucial role in identifying, analysing and mitigating these risks.

Using tools such as risk assessment, insurance strategies and financial derivatives, finance professionals can safeguard their company’s financial wellbeing, ensuring that its risks are managed and that the company can continue to be financially resilient going forward.

6. Ensures payment of taxes, debts, dividends and interest

Corporate finance strategies are essential in managing a company’s financial obligations, including its taxes, debts, dividends and interest payments.

At all times, an organisation must comply with tax regulations and ensure the timely repayment of debt, as this, in turn, is essential in maintaining the company’s credibility and financial stability.

Regular dividends and interest payments are also vital for attracting and retaining investors.

7. Enables asset replacement

Assets of all types are the backbone of many businesses and their efficient management is necessary for their successful operation.

Corporate finance professionals ensure that their company’s assets can be replaced by making funds available for upgrading or replacing outdated equipment and infrastructure. Being proactive in this respect helps maintain operational efficiency, reduces downtime and ensures that the organisation can stay competitive.

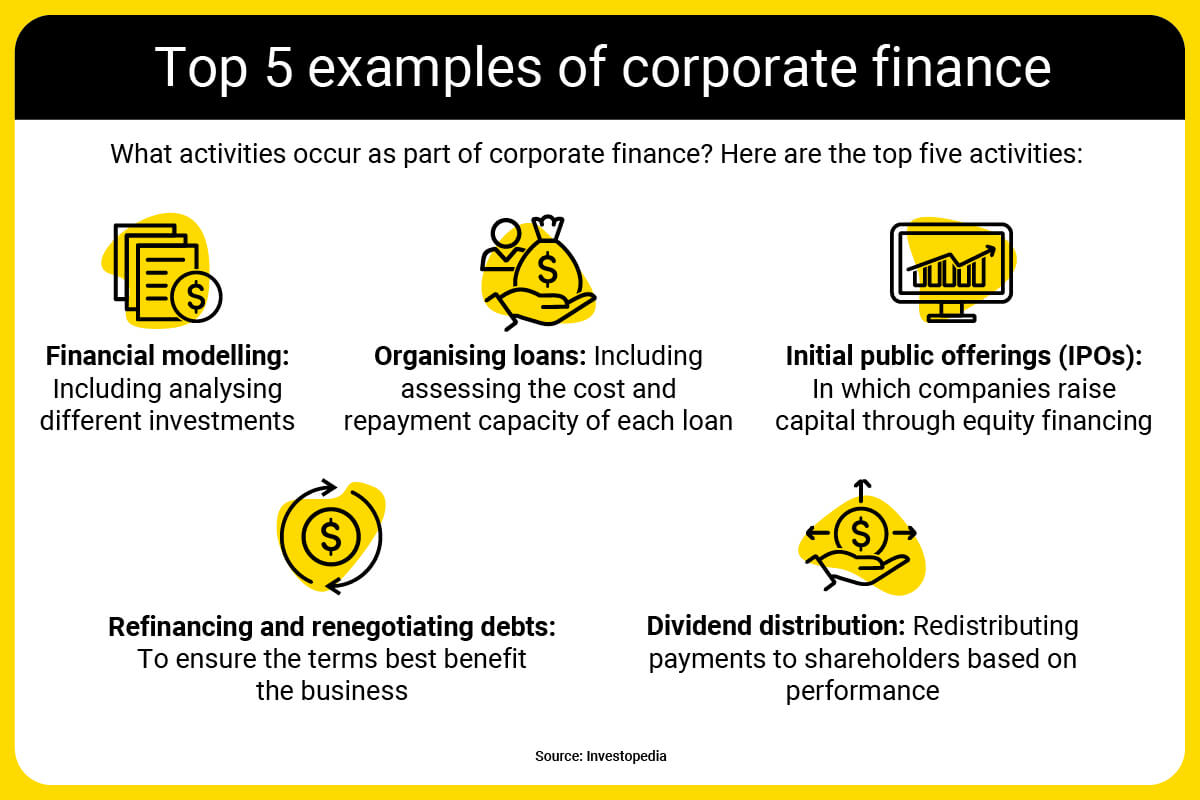

Examples of corporate finance activities

Corporate finance encompasses a diverse range of activities, each of which plays a crucial role in maintaining a company’s financial health and growth. Here are 10 key examples of corporate finance activities.

1. Financial modelling

Financial modelling involves creating mathematical representations of a company’s financial situation. These models analyse the value and risks associated with different investments.

Using such models, finance managers can assess potential scenarios, which allows decision-makers to make informed choices on investments, mergers and acquisitions. Financial models help companies both optimise their returns and manage the associated risks.

2. Organising loans

To ensure growth, organisations often seek external funding through loans.

Corporate finance professionals are responsible for organising these loans. This process involves performing due diligence to analyse the cost of the loan in comparison to the business’s ability to repay it. This includes assessing the loan’s interest rate, terms and collateral requirements and ensuring that the financial terms align with the company’s strategic objectives and financial health.

3. Initial public offerings

When a company offers shares to the public for the first time, it is called an initial public offering (IPO). This is an important milestone for an organisation.

An IPO is a form of equity financing that allows companies to raise capital by selling stakes in the organisation. Corporate finance professionals play a crucial role in preparing a company for an IPO, performing activities such as determining the offering price and ensuring compliance with regulatory requirements.

Success in an IPO is vital and can impact an organisation’s ability to fund its future projects.

4. Refinancing and renegotiating debts

Organisations can face volatile financial conditions that necessitate the refinancing or renegotiation of their existing debts.

Corporate finance teams are involved in assessing their company’s current debt structures, interest rates and repayment terms for their debts. Refinancing these debts aims to optimise these terms, ensuring that the company benefits from the most favourable conditions, such as lower interest rates or extended repayment periods.

Renegotiating debts is crucial to aligning an organisation’s financial obligations with its capacity to pay, as well as with market conditions.

5. Dividend distribution

Dividend distribution involves redistributing profits to shareholders based on an organisation’s performance.

Corporate finance professionals play a key role in determining the amount and timing of dividends. This activity requires a careful balance between rewarding shareholders and retaining funds for future growth.

Effective dividend policies are integral to maintaining investor confidence and attracting new investors.

6. Monitoring shareholder equity

Understanding the composition of their company’s shareholder equity is essential for corporate finance teams. Monitoring shareholder equity involves analysing how much the company’s owners have invested in terms of equity compared to the organisation’s liabilities.

By monitoring shareholder equity, corporate finance professionals gain insights into the company’s financial structure and solvency and the extent to which the business is financed by external sources versus internal ownership.

7. Capital budgeting

Capital budgeting is the process of evaluating and selecting major projects by analysing their cash inflows versus their outflows.

Corporate finance professionals use various techniques, such as net present value (NPV) and internal rate of return (IRR), to assess the viability and profitability of potential investments. This ensures that resources are allocated to projects that align with the company’s strategic goals and offer the best potential return on investment.

8. Managing short-term liquidity

Maintaining short-term liquidity is essential to smooth business operations.

Corporate finance teams actively manage an organisation’s cash position to ensure there is enough liquidity to cover day-to-day operational expenses such as payroll and purchasing. This involves monitoring cash flows, managing working capital and applying short-term financing options when needed.

9. Managing debt

Corporate finance professionals manage the balance between the amount of debt and the amount of equity their organisation holds. This involves optimising the capital structure to minimise the cost of capital, while also maintaining a healthy level of leverage. Leverage is the use of debt to amplify returns from an investment.

Effective debt management ensures that an organisation can meet its financial obligations without jeopardising its long-term financial stability.

10. Distributing retained earnings

Retained earnings are the profits that are not distributed back to shareholders.

Corporate finance teams play a vital role in determining how to allocate these retained earnings. This includes ensuring that funds are retained for future business expansion, research and development or other strategic initiatives.

Balancing the distribution of retained earnings with the need for internal investment is crucial to sustaining a company’s long-term growth.

Current and future corporate finance trends

The world of corporate finance is undergoing a significant transformation. Corporate finance professionals should be aware of five significant finance trends that are poised to shape the future.

1. AI and robotics will dominate

The influence of artificial intelligence (AI) and robotics in corporate finance will continue to grow. Automation is becoming a cornerstone of operational efficiency, enabling chief financial officers to allocate more time to strategic decision making. Routine and repetitive tasks such as data entry and basic financial analysis can be delegated to intelligent machines, allowing finance professionals to focus on value-added activities.

However, this shift also poses challenges in terms of training the workforce to navigate the evolving technological landscape.

2. Competition for talent will intensify

The demand for skilled finance professionals is on the rise, intensifying the competition for top talent. As companies vie for the best minds in finance, the cost of acquiring and retaining skilled professionals is expected to increase.

This escalation in talent costs will impact the overall cost base of businesses, necessitating a strategic approach to talent management. Companies will need to invest in employee development, establish lucrative compensation packages and foster a workplace culture that attracts and retains top-tier finance talent.

3. Uncertainty will continue

Uncertainty remains a constant in the corporate finance environment. Ongoing geopolitical tensions, the aftermath of the COVID-19 pandemic and inflationary pressures are expected to continue to contribute to a volatile financial landscape.

Corporate finance professionals will need to navigate this uncertainty by implementing agile financial strategies, scenario planning and risk-mitigation measures. Flexibility and adaptability will be crucial, as businesses strive to weather unforeseen challenges and capitalise on emerging opportunities.

4. Climate risks will continue to affect financial institutions

Climate change will continue to impact many areas of life and financial institutions are no exception. The increasing cadency of severe weather, natural disasters and related effects such as flooding poses risks to the Australian financial landscape and will likely change how institutions operate.

Some of the most prevalent risks banks will face will relate to property and housing loans, including serviceability risks, balance sheet volatility and land devaluation. Australian properties’ Value at Risk (VaR), which balances the expected cost of climate-related damage against repair and replacement expenses, is currently above 1 per cent for approximately 3.5 per cent of dwellings. In the next 80 years, VaR figures are projected to rise 8 per cent. Additionally, the heightened probability of land and property damage could cause mortgage holders without the necessary insurance to go into default. This could yield consequential losses for banks due to declining property value.

5. ESG will become more important

Environmental, social and governance (ESG) considerations will continue to gain prominence in corporate finance. Stakeholders — including investors, customers and regulatory bodies — are placing increasing importance on sustainable and socially responsible business practices.

Companies will be expected to demonstrate strong ESG performance, not only for ethical reasons but also to secure their investments and maintain their competitive positions. Integrating ESG principles into financial decision-making processes will be essential for corporate finance professionals seeking to align their organisations with evolving societal expectations.

Corporate finance: The backbone of business

Corporate finance has long been the backbone of business and will continue to be in the future. But corporate finance practices are being transformed by technological advancements, economic shifts and global events. Just a few decades ago, most businesses had access to only a few funding options, while now they can choose from a number of new sources of funding, from non-traditional banks to startup funding.

There’s never been a more interesting time to consider a career — and a future — in this exciting and ever-changing field. The online Master of Applied Finance at UNSW offers a core course in corporate finance, which provides you with the practical knowledge and tools to upskill or switch to a role in this profession.

Through this program, you will access the latest developments and research in this field and learn to confidently apply current corporate financial practices at work.

For more details about how UNSW Online’s Master of Applied Finance can advance your career, visit our website or reach out to our Enrolment team on 1300 974 990.