Most people think of finance as the business of making financial decisions and managing other people's money. In reality, there's a lot more to it than that.

Traditionally, the field of finance is concerned with the management and allocation of financial resources over time. This can involve investing in stocks and shares or lending money to businesses and individuals.

However, today, there's a growing trend for finance jobs to require more specialised skills and knowledge, which is where applied finance comes in.

What is applied finance? A deeper dive

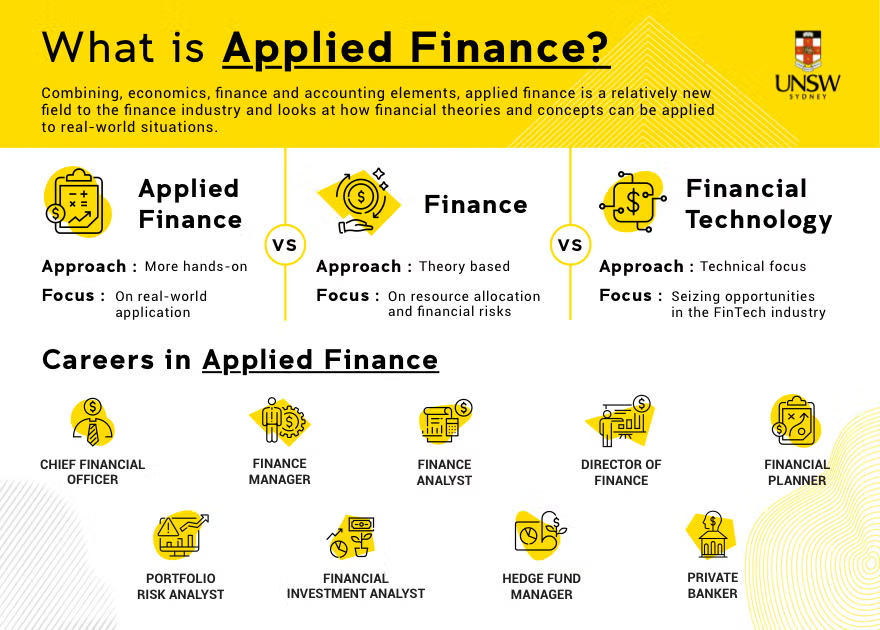

Applied finance is the study of how to use financial theories and concepts in real-world situations. It's a relatively new field that combines economics, accounting and finance elements.

While there are many different specialisations within applied finance, most programs will cover financial statement analysis, investment management, risk management and financial modelling.

Applied finance programs are designed to give students the skills and knowledge they need to work in various finance-related roles. They'll learn how to analyse financial data, understand economic trends and develop financial models.

What's the difference between finance and applied finance?

Many prospective students find it difficult to choose the right program for their projected career paths when it comes to these two areas. Let's make those blurred lines more clear-cut.

The main difference between finance and applied finance is that finance focuses on the theory of financial concepts, while applied finance uses these concepts to solve real-world problems.

Finance

Finance is primarily concerned with the efficient allocation of resources and managing financial risks.

It covers a broad range of topics, from investment analysis and portfolio management to corporate finance and derivative pricing.

Finance degree programs tend to be more theoretical.

Applied finance

Applied finance takes a more hands-on approach.

It uses financial principles and techniques to solve practical problems in areas like investment management, risk management and financial planning.

Applied finance programs place greater emphasis on real-world applications.

Study applied finance at a postgrad level

Finance is now a more heavily regulated industry thanks to the global financial crisis, which highlighted the need for better regulation and more qualified professionals in the field.

The good news? Finance experts qualified to navigate the new landscape are now in hot demand.

An online Master of Applied Finance at UNSW helps you put your financial theory into practice. The program is designed to ensure you can confidently apply, manage and lead financial functions at all business levels - both in Australia and around the world - and be an asset to any forward-thinking financial organisation

Plus, you can also select a study pathway that is closely aligned with the Chartered Financial Analyst (CFA) curriculum, giving you a strong grounding to pursue the CFA designation. Whatever your interests, this program delivers access to the latest thinking and current research in finance.

What's the Chartered Financial Analyst (CFA) qualification?

The CFA is widely regarded as one of the world’s top finance certifications. It's a globally recognised credential awarded to financial professionals who meet specific educational, ethical and work experience standards.

What does studying the CFA look like?

The CFA program is for finance professionals who want to develop their skills and knowledge to pursue a career in investment analysis or portfolio management.

The program is self-directed and assessed through three exams, so candidates must have the discipline and commitment to see the program through.

Can I study to become a Chartered Financial Analyst?

The CFA curriculum covers a broad range of topics, from investment analysis and portfolio management to corporate finance and derivative pricing. To be eligible for the CFA program, candidates must have a bachelor's degree from an accredited university.

You also need at least four years of professional work experience. However, the CFA Institute offers a unique pathway for master’s degree students that allows them to waive the work experience requirement and instead complete a series of exams.

The online Master of Applied Finance at UNSW is closely aligned with the CFA curriculum, giving you a strong grounding to pursue CFA designation.

What are the benefits of becoming a CFA charterholder?

There are plenty of reasons why the CFA is so sought after by professionals in finance. Most notably, the designation is globally respected and demonstrates a high level of proficiency in financial analysis, which opens up a wealth of career opportunities in the finance industry.

The Chartered Institute for Securities and Investment (CISI) curriculum and CFA program are closely aligned. That means students who complete the CFA program will have a firm grounding in financial analysis and investment management.

What are the CFA salary expectations in Australia?

The CFA designation is globally recognised and highly respected, so it’s no surprise that finance professionals' salaries are competitive.

In Australia, the average salary for a CFA charterholder ranges from $A98,000 to $A125,000 per year. This reflects the experience and expertise that CFA holders bring to the table.

Most importantly, the CFA qualification is recognised and respected by employers worldwide, so it's definitely worth the investment of time and effort.

While the CFA designation isn't a requirement to work in finance, it's becoming increasingly common for employers to prefer or require candidates to have it. This means that if you're interested in a career in finance, pursuing a master's degree in applied finance could give you a significant advantage.

Take your finance career further with postgraduate study

Finance has always been a popular career choice and with good reason. It offers stability, high pay and the opportunity to work in various industries.

But the finance industry's landscape is changing. Employers are looking for candidates with specialised skills and knowledge in an increasingly globalised and complex world.

That means to have a more successful career in finance and climb the corporate ladder, finishing study at an undergraduate level won't cut it.

After studying finance at a postgrad level, many graduates move on to pursue a higher role in the finance industry.

Positions such as financial analyst, investment banker and portfolio manager are popular choices, as they offer excellent opportunities for growth and development and can lead to a successful career in finance.

Why study the online Master of Applied Finance at UNSW?

The 100% online Master of Applied Finance (MAF) at UNSW is the perfect qualification for working professionals seeking to upskill in finance. The program offers a broad range of elective courses, allowing you to specialise in an area that best suits your career goals.

We designed the Master of Applied Finance to equip graduates with the skills and knowledge required to confidently apply, manage and lead financial functions in any business. The program covers key areas such as analytics, financial technology and business management, providing a well-rounded understanding of the finance industry.

The online Master of Applied Finance is an ideal qualification for busy professionals looking to upskill in the finance industry and build a solid foundation to pursue the Chartered Financial Analyst (CFA) designation. And because it’s 100% online, you can study part-time at an accelerated rate while still working full time – so you can get to where you’re going faster.

Unlock your value with UNSW Online

Whether you choose to study on-campus or online, after completing one of our finance programs, you’ll be well-equipped to pursue a higher role within the finance industry. With these qualifications under your belt, you’ll soon be doing your best work and climbing the corporate ladder.

With the right qualifications and experience, there's no limit to what you can achieve in your career

To learn more about the online Master of Applied Finance, get in touch with an Enrolment Advisor to discuss your pathway. Or, if you are interested in studying one of our programs in person, contact our on-campus team.