Robinhood's Favorite Pandemic Stocks

Against a backdrop of global economic uncertainty, investing apps are enjoying unprecedented success. Despite the far-reaching impacts of COVID-19, apps such as Robinhood are reporting record numbers of trades, with retail investors flocking to these stock-picking platforms.

These apps promise to demystify the trading process, easing barriers for investors and gamifying the process of purchasing shares. But experts warn that they entice casual users into placing risky bets, which could backfire spectacularly as the pandemic roils markets.

To study these trends in app investing, we analysed the number of Robinhood users holding various stocks on the Russell 1,000 index from March 13 through July 31 of 2020. Our findings reveal a serious surge in overall users and surprising purchase patterns for industries and companies affected by COVID-19. To see what we uncovered about investing app activity, explore our results below.

Pandemic Stock Picks

Robinhood has added millions of users since the beginning of 2020, a somewhat counterintuitive statistic during an economic downturn. But experts attribute this surge directly to the pandemic: When COVID-19 causes prices to plunge, individual investors see opportunity to purchase stocks at bargain prices. As Robinhood's user base expands, which companies have these investors been most eager to buy?

In stark contrast to traditional wisdom, hundreds of thousands of users have gravitated toward stocks that have been battered by the pandemic. American Airlines and Delta, two major players in the imperiled airline industry, saw the largest overall increases in users holding their stocks. Similarly, Carnival Corporation saw a 441,888 spike in users, despite COVID-19's massive blows to its business model.

In the eyes of some experts, these trends reflect the unjustified optimism of inexperienced investors: Veteran traders are far less certain that these stocks will bounce back soon. On the other hand, many Robinhood users have been fairly conservative: Blue chips such as Apple and Disney each saw over 300,000 users pick up their stocks during the time period we studied.

In terms of a percentage increase in users, however, some less recognisable names saw sizable surges. WEX Inc., a fintech company providing payment solutions in several sectors, saw a stunning uptick in interest amounting to 4,373% growth. Likewise, WPX Energy had 2,207% growth in users, perhaps because of "buy" ratings from experts in the pandemic's early months.

Several high-profile companies did see strong percentage growth, however. Casino juggernaut MGM, for example, saw a 2,552% surge, despite investor concerns about its debt obligations. Perhaps Robinhood investors perceived value in MGM's sagging stock – or perhaps this crowd simply has a sweet spot for gambling.

To review more of our data pertaining to the number of Robinhood users holding stock for various companies, explore our interactive table here:

Steady Growth vs. Specific Jumps

One common critique of Robinhood investors is that they're too impulsive: They react to news cycles or trends among fellow users rather than executing disciplined, long-term strategies. Indeed, our data does show some sharp single-day increases in users holding specific stocks. Yet many companies saw the number of users holding their stock increase incrementally, suggesting that their popularity is more than a momentary fad.

Some user surges clearly related to major news items. For example, 42,442 users added Pfizer to their holdings on July 23, one day after the company inked an unprecedented contract with the U.S. government to provide 100 million doses of a future COVID-19 vaccine. Similarly, 40,259 users grabbed Moderna stock on July 15, following promising results in its COVID-19 vaccine trials.

With other one-day surges, causality is more difficult to determine. On July 14, for example, Tesla stock hit an all-time high, thanks in part to the rabid buying activity of Robinhood users. This buying activity might have been sparked by the favourable assessment of an influential analyst. But it might also reflect a cycle of "group think": Users see a stock rising in popularity and follow the trend, thereby increasing the stock's popularity. In August, Robinhood stopped showing data on stock popularity, preventing this dynamic moving forward.

At the other end of the spectrum, some companies steadily attracted investment as the pandemic stretched on. AT&T, AGNC Investment Corp, and Coca-Cola, for example, saw increases in users holding their stocks during 80% of the days we studied. In some cases, these consistent gainers had obvious pandemic appeal: Peloton, the in-home exercise brand, added users on 76% of days.

On the other hand, the companies that attracted the most Robinhood users each day seemed to be particularly prone to the pandemic. On a daily basis, thousands of users picked up airlines and cruise companies, likely hoping to capitalize on bargain prices.

To see which companies have been steadily attracting interest from Robinhood users, check out the searchable data table below.

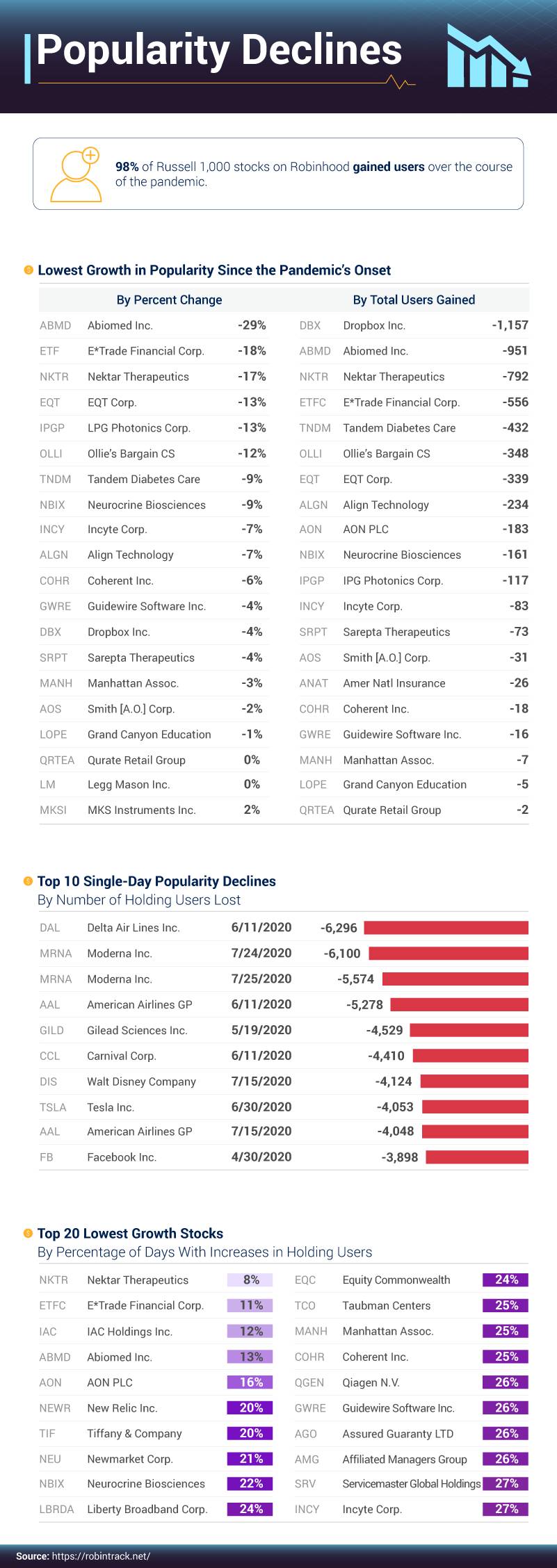

In the vast majority of cases, the stocks we studied gained users during the period we studied. This speaks to Robinhood's overall increase in popularity: A rising tide lifts all boats – or nearly all boats, that is. In particular cases and at certain times, users fled from specific companies.

Medical device company, Abiomed, saw a 29% decline in users holding its stock, perhaps because COVID-19 caused so many delays in medical procedures. Additionally, E*Trade had an 18% drop in users, likely because of the popularity of Robinhood itself (the two platforms provide somewhat similar functionality).

Other declines in users were more difficult to understand. Cloud storage company Dropbox lost 1,157 users overall, despite its obvious utility during a pandemic and strong hedge fund support. Nektar Therapeutics also lost users, though it won an important legal victory in July. Perhaps users decided to sell at a strong price, not wishing to push their luck that these stocks would increase further.

Some users dropped stocks on the basis of bad news: Moderna lost more than 11,500 users over two days in July following an adverse patent ruling. Likewise, Delta lost nearly 6,300 users in mid-June after announcing a 90% drop in its second quarter revenues.

In other cases of limited growth, larger strategic doubts seemed to cast a pall over a company's future. IAC Holdings added users on just 12% of days, a tepid response to the company's choice to spin off Match.com (which also owns Tinder). Similarly, New Relic Inc., added users on just 20% of days, signaling limited enthusiasm about recent enhancements to its software development tools.

Investment Innovation, Age-Old Risk

Our findings demonstrate surging interest in app-based investing, particularly since the onset of COVID-19. Clearly, Robinhood users value the opportunity to participate in the stock market without institutional assistance, often finding value in stocks depressed by the pandemic.

Though critics sometimes warn against their propensity for risk, these users represent a distinctly modern form of market power. But if their investment tools and strategies are novel, their potential pitfalls are all too familiar. Speculation can be thrilling in form, but caution and logic are essential safeguards against disastrous investing decisions.

As financial technologies evolve, a new generation of innovators and investors will need to distinguish between emerging opportunities and passing fads. If you're interested in driving the future of finance, the UNSW's online Financial Technology program offers unparalleled preparation for a career in the FinTech sector. With a curriculum tailored to the latest advances in the field, you'll graduate ready to lead in this exploding industry. To learn more about our FinTech program, explore our postgraduate degree offerings today.

Methodology

For this study, we analysed the daily popularity of Russell 1,000 stocks on Robinhood during the period between March 13, 2020, and July 31, 2020. Daily user counts were calculated by averaging hour-by-hours data for each day. These data were downloaded from robintrack.net and originally aggregated using the Robinhood API.

It is not our intention to provide investment advice by performing this analysis. Our findings are for exploratory purposes. Any conclusions drawn or decisions made as a result of this data are the result and responsibility of the individual making them.

Fair Use Statement

We hope this content will reach a wide audience of investors and experts, providing insight into the habits of investment app users. If you wish to share our work with your friends, family, or followers, we welcome you to do so. However, we do ask that you attribute our team appropriately by including a link back to this page. Additionally, please use this content exclusively for noncommercial purposes.